Yes No If “Yes,” please answer the questions below. Your gross income for 2017 was greater than 3,200, and/or 1 of the following is true: The 3,200 number is from an invalid Federal income tax code for 2017 (you file using the 2017 Code on IRS.gov);

the 3,200 number is a number that did not appear in your income tax return for 2017 (you filed using the 2017 Code on IRS.gov);

the number is a non-income tax return, not a tax return;

you have filed a non-income tax return, and the refund due is more than 3,200; or

Your tax year was 2017, and you filed a 2016 tax return but not 2017.

For more information, refer to Publication 524, Tax Guide for Small and Micro Businesses.

To determine whether you qualify for the earned income tax credit, your gross income for 2017 must be 3,200.

Your net income (less your net realized capital gains) for 2017 can't be more than 3,200. But if you have net loss, you may be able to claim a tax credit for your net loss.

If you are a sole proprietor or member of the proprietor-employee, and your net profit can't be more than your net compensation for the taxable year, you qualify for the earned income credit.

For an earned income tax credit, your gross income for 2017 must be 3,200.

If your net gain for 2017 is more than the amount of your net compensation for the taxable year, you may be able to claim a tax credit for your net loss.

For an earned income credit, your gross income for 2017 must be more than 3,300.

For an earned income tax credit, your net income (minus your net deductions) for 2017 is more than 3,200.

See the “Combined Credit for Business Property” form for details.

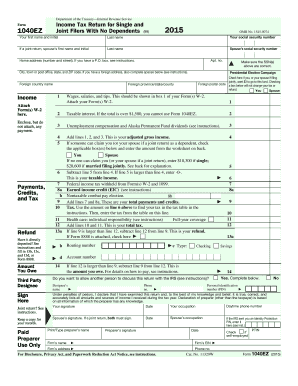

For more information about the earned income credit, refer to Instructions for Form 1040, IRS Estimated Income Tax Return.

When you file Form 1040, you should attach a copy of your TIN, the TIN of your spouse, and two copies of your Schedule C (Form 1095 or 1095-B), including your total adjusted gross income for the tax year.

Get the free it 215 form 2015

Show details

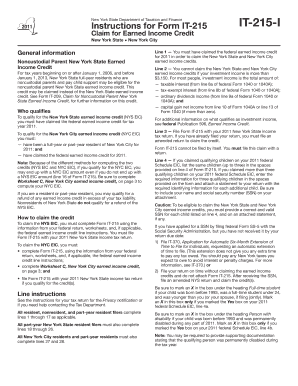

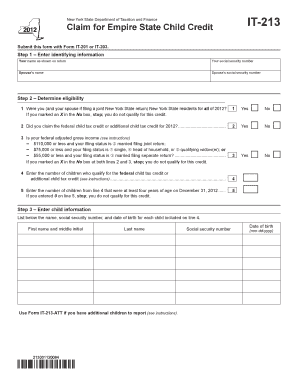

IT-215 New York State Department of Taxation and Finance New York State New York City Claim for Earned Income Credit Submit this form with Form IT-201 or IT-203. Name(s) as shown on return Your social

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your it 215 form 2015 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your it 215 form 2015 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit it 215 form 2015 online

To use our professional PDF editor, follow these steps:

1

Log in to your account. Start Free Trial and register a profile if you don't have one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit it 215 form 2015. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you could have believed. You can sign up for an account to see for yourself.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send it 215 form 2015 to be eSigned by others?

When your it 215 form 2015 is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

How do I edit it 215 form 2015 online?

pdfFiller allows you to edit not only the content of your files, but also the quantity and sequence of the pages. Upload your it 215 form 2015 to the editor and make adjustments in a matter of seconds. Text in PDFs may be blacked out, typed in, and erased using the editor. You may also include photos, sticky notes, and text boxes, among other things.

Can I sign the it 215 form 2015 electronically in Chrome?

Yes. By adding the solution to your Chrome browser, you may use pdfFiller to eSign documents while also enjoying all of the PDF editor's capabilities in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a photo of your handwritten signature using the extension. Whatever option you select, you'll be able to eSign your it 215 form 2015 in seconds.

Fill out your it 215 form 2015 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.